As a small investor, diving into the world of 선물옵션 futures trading might seem daunting at first. Don’t let the size and intricacy of the market discourage you though, it’s still possible to thrive even with a limited account. Our article is here to offer up some tips and tricks to help you succeed in futures trading, no matter the size of your portfolio.

Choose the Right Futures Contract

Starting your journey in futures trading requires selecting the perfect contract that caters to your needs. Futures contracts offer a fixed agreement to buy or sell an underlying asset at a set cost and date. Each contract has varying standards, including the asset, size, tick, and expiration date. It’s important to diligently research and understand these specifications before diving into futures trading.

Selecting the right futures contract to trade 해외선물커뮤니티 involves weighing several crucial factors. Your trading style, appetite for risk, and market knowledge all play a key role. Additionally, keep in mind that margin requirements and contract specifications can differ significantly across contracts. Make an informed decision to secure the best results.

Use Leverage Carefully

Futures trading offers the enticing opportunity to 해외선물대여계좌 control a sizeable amount of underlying assets with just a small amount of capital, thanks to the magic of leverage. As with anything powerful, it’s important to use leverage carefully, as it can also magnify your losses.

For those starting out as small account traders, a moderate amount of leverage is key to seizing market opportunities without putting your capital at too much risk. Remember to always have a sound strategy in place for managing risk and reducing losses in case the market takes a turn for the worse.

Practice Risk Management

Futures trading offers lucrative opportunities, but there’s a catch – risk. This makes risk management a crucial factor that can make or break your trading portfolio. For small account traders, it’s vital to be extra cautious as a few major losses can jeopardize their entire account. Therefore, incorporating a solid risk management strategy is a must to thrive in the turbulent world of futures trading해외선물.

Protect your investments by implementing a stop-loss strategy to minimize potential losses during market fluctuations. Additionally, resist the temptation to overtrade and take a step back if the market isn’t presenting favorable opportunities. A disciplined approach to risk management can lead to long-term success in trading.

Use Technical Analysis

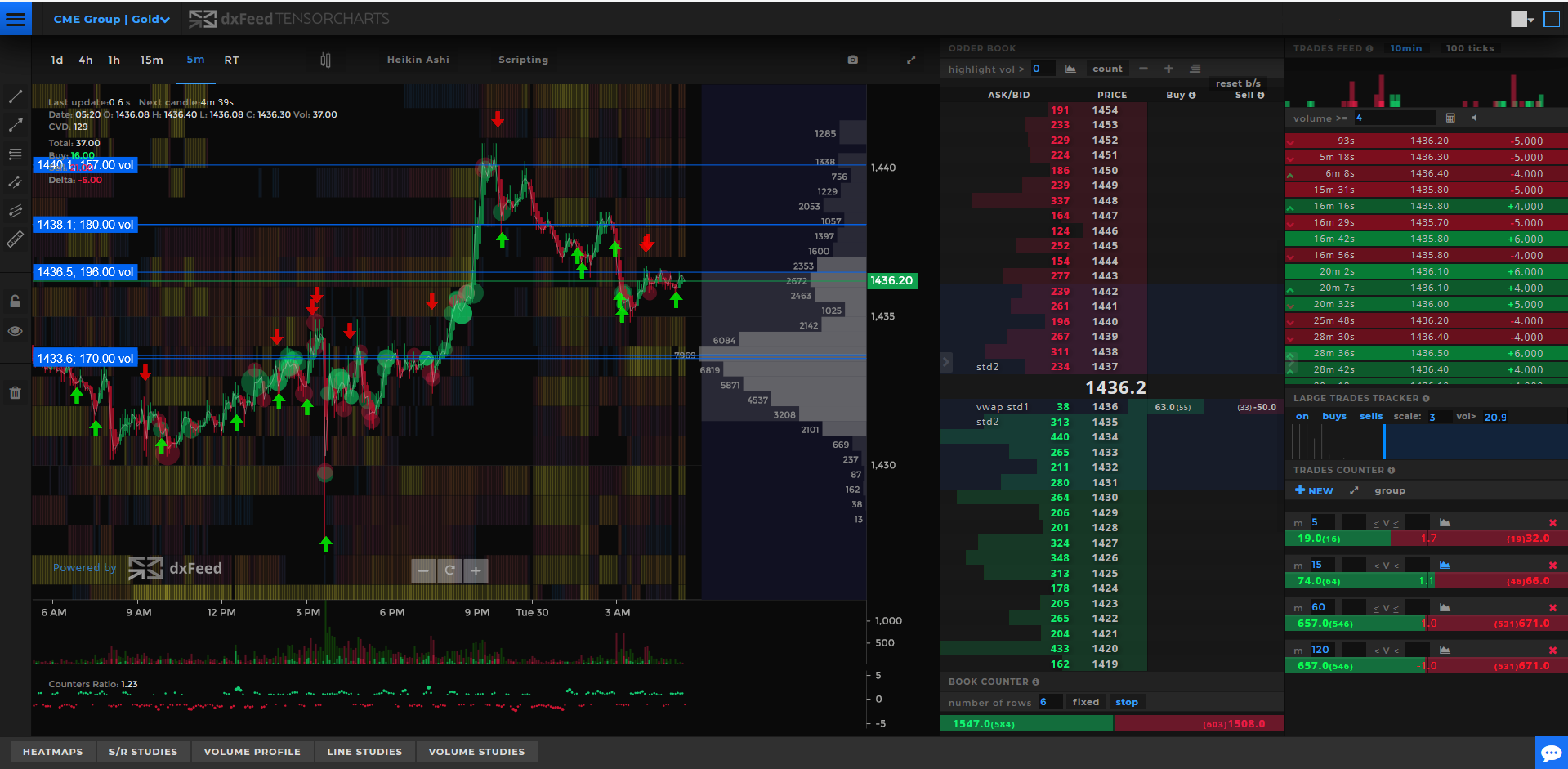

Enhance your futures trading strategy with the power of technical analysis. This valuable tool enables you to pinpoint market trends, determine support and resistance levels, and uncover hidden patterns. Make data-driven decisions to increase your success rate and elevate your trading game.

There are many different technical indicators and chart patterns that you can use in futures trading, such as moving averages, Fibonacci retracements, and candlestick patterns. You should experiment with different indicators and find the ones that work best for your trading style.

Stay Informed

To be a successful trader, it’s vital to 해외선물뉴스 stay in the know about your target market and its underlying assets. By keeping up with important news and events such as economic reports, geopolitical happenings, or weather conditions, you’ll be better positioned to make informed decisions and ultimately maximize your returns. So don’t neglect the power of knowledge and stay plugged into the latest market happenings!

Stay ahead of the game in futures trading by following seasoned traders and analysts on social media and trading forums – this is an invaluable way to gain insights and fresh ideas. Being informed means making informed decisions, and that’s how you win in this competitive market. Keep your finger on the pulse!

For those looking to dive into futures trading with a small account, it’s important to note that this exciting world requires careful planning and consideration. By selecting the right contract, utilizing leverage with precision, heeding risk management strategies, staying up-to-date with technical analysis and remaining informed on market trends, small account traders can increase their chances of success. Although challenging, the rewards of futures trading are well worth the effort.